argusdusty.github.io

Negative Risk on PredictIt

PredictIt ‘Risk’

When you buy and sell shares in a multiple-contract market on PredictIt, PredictIt computes the maximum possible amount of money you can lose in any outcome, and only charges you that amount from your available balance, rather than the actual cost of the shares. This ‘maximum possible loss’ is known as your risk for the market.

The advantage of this system is that if your risk is lower than the cost of the shares you purchased, you can go and spend that money elsewhere, allowing you to get a potentially higher return on a smaller investment.

If you’re smart about your trades, you can minimize your risk without reducing your potential profit, leaving you extra money available to invest in other markets. You may even be able to get your risk to be negative, leaving you immediately with more money than you started with in your available balance.

Basic Tips To Minimize Your Risk

- Buy No shares instead of Yes shares. Owning No shares in multiple contracts will always give you a lower risk than the total purchase value of those shares. PredictIt includes a potential ‘all of these contracts resolve no’ option in risk calculations so you can never have negative risk with Yes shares. Additionally Yes share prices in PredictIt markets are overpriced due to user biases.

- PredictIt will display how much your risk changes in the “Preview” menu before you submit a trade order under “Minimum Credit”/”Maximum Debit”. You can play around with the number of shares to try to optimize how much credit you get.

- Markets with a larger number of contracts are easier to minimize risk in. Big elections or bracketed markets (like poll markets or tweet markets) are great for this.

- In higher-volume markets, place orders below the current Buy No prices (but above Sell No). People buying up Yes shares will be happy to get a lower price, and you get a lower risk.

- Keep in mind the limits of shares you can buy. There are only a finite amount of shares available, and you are limited to owning a maximum of $850 of shares in each contract (regardless of risk)

- Keep in mind the 10% fee on profit (but not loss) that PredictIt takes. This is included in risk calculations by PredictIt (it’s why risk, and profit, is shown in tenths of a cent)

An Example

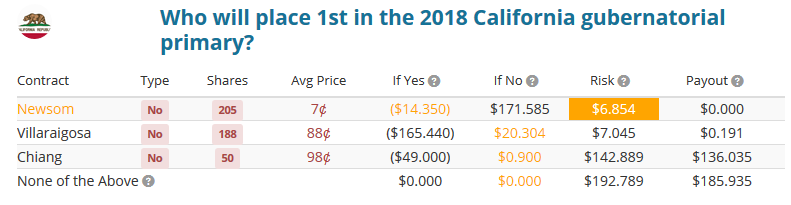

Above is an example of negative risk. The maximum possible loss is negative $6.854, meaning a minimum possible gain of $6.854. Buy purchasing those shares you are guaranteed to win at least $6.854, so after all the trades were completed PredictIt will have credited available balance a net $6.854, and even the potential for additional profit if someone other than Newsom wins the election.

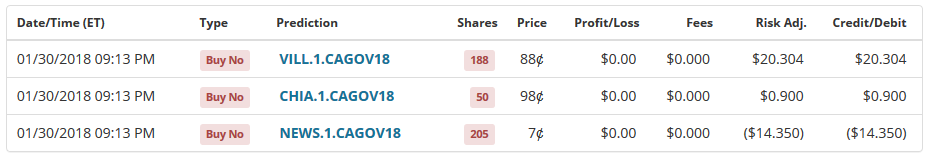

Above you can see the trades done to get to negative risk in that market.

The first trade cost $14.35 in shares, and because those were the only shares owned the risk was $14.35, so PredictIt subtracted $14.35 from available balance.

The second trade, however, reduced the overall risk. The cost of the shares would have been $49, but instead the maximum possible loss following the purchase was $13.45. The risk decreased by $0.9, so PredictIt, instead of charging $49, credits you back $0.9.

The third trade puts it at negative risk. From $13.45 to ($6.854), a net decrease of $20.304. So instead of charging $165.44, the cost of the shares, PredictIt credits you back $20.304.

The total amount paid for those 3 trades was negative $6.854, leaving you with more than you started with.

But we can do even better:

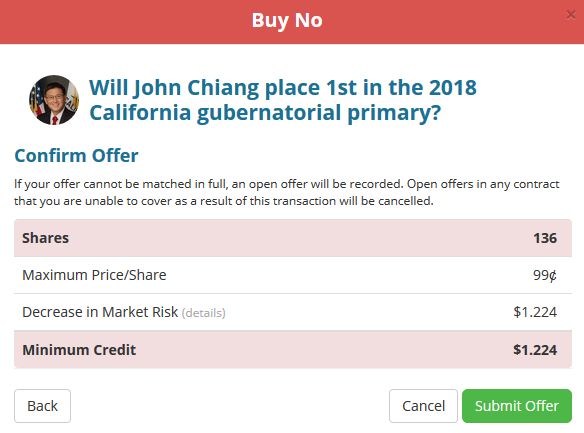

Above is the Preview menu before you submit an offer (mentioned in point 2 for Basic Tips To Minimize Your Risk) for a trade order done to decrease the risk even further.

By buying those 136 No shares you would be credited an additional $1.224. If it was been 137 shares the amount would be $0.405, and if it was been 135 shares the amount would have been $1.215 so 136 is the optimal number to buy there. This puts the negative risk up to a total of $8.078.

Math Time

So how do you compute risk? It’s an important question if you want to properly minimize your risk, or get to negative risk. Well, as stated above, the risk is the maximum possible loss you can incur. That is, it’s the maximum of your loss from each contract resolving Yes, or from all of them resolving No. Let’s take a look at that 3-contract market I posted above. There are 4 possibilities, which the images above show:

- The case if Newsom wins:

- You lose the value of the No shares on Newsom: 205*$0.07 = $14.35

- But you gain the value from your No shares in Villaraigosa (minus the 10% fee): 188*($1-$0.88)*0.9 = $20.304

- And you gain the value from your No shares in Chiang (minus the 10% fee): 50*($1-$0.98)*0.9 = $0.9

- Your net loss is the difference between them: $14.35-$20.304-$0.9 = -$6.854

- The case if Villaraigosa wins:

- You lose the value of the No shares on Villaraigosa: 188*$0.88 = $165.44

- But you gain the value from your No shares in Newsom (minus the 10% fee): 205*($1-$0.07)*0.9 = $171.585

- And you gain the value from your No shares in Chiang (minus the 10% fee): 50*($1-$0.98)*0.9 = $0.9

- Your net loss is the difference between them: $165.44-$171.585-$0.9 = -$7.045

- The case if Chiang wins:

- You lose the value of the No shares on Chiang: 50*$0.98 = $49

- But you gain the value from your No shares in Newsom (minus the 10% fee): 205*($1-$0.07)*0.9 = $171.585

- And you gain the value from your No shares in Villaraigosa (minus the 10% fee): 188*($1-$0.88)*0.9 = $20.304

- Your net loss is the difference between them: $49-$171.585-$20.304 = -$142.889

- The case if none of those wins:

- You gain the value from your No shares in Newsom (minus the 10% fee): 205*($1-$0.07)*0.9 = $171.585

- And you gain the value from your No shares in Villaraigosa (minus the 10% fee): 188*($1-$0.88)*0.9 = $20.304

- And you gain the value from your No shares in Chiang (minus the 10% fee): 50*($1-$0.98)*0.9 = $0.9

- Your net loss is the sum of them: -$171.585-$20.304-$0.9 = -$192.789

A negative loss here indicates a positive gain. You can see the maximum possible loss is -$6.854, and that becomes your risk. Because that risk is negative you’re guaranteed to make money. PredictIt does this calculation for you and credits you back that money as you purchase the shares. Later when the market resolves, it credits you any additional money you won.

If Newsom wins you get no additional value (because that was the same as the negative risk that you were already credited), but if Chiang wins you are credited an additional $136.035, the difference between your loss if Chiang wins and your risk.

I’ll leave it as an exercise to the reader to take this math a bit further and determine when a market could theoretically give out negative risk, and the optimal number of shares to purchase.

Further Reading

Check out PredictIt’s FAQ Which goes quite in depth on the idea and calculation of risk under Multiple-Contract Markets